Transcript

Transcript

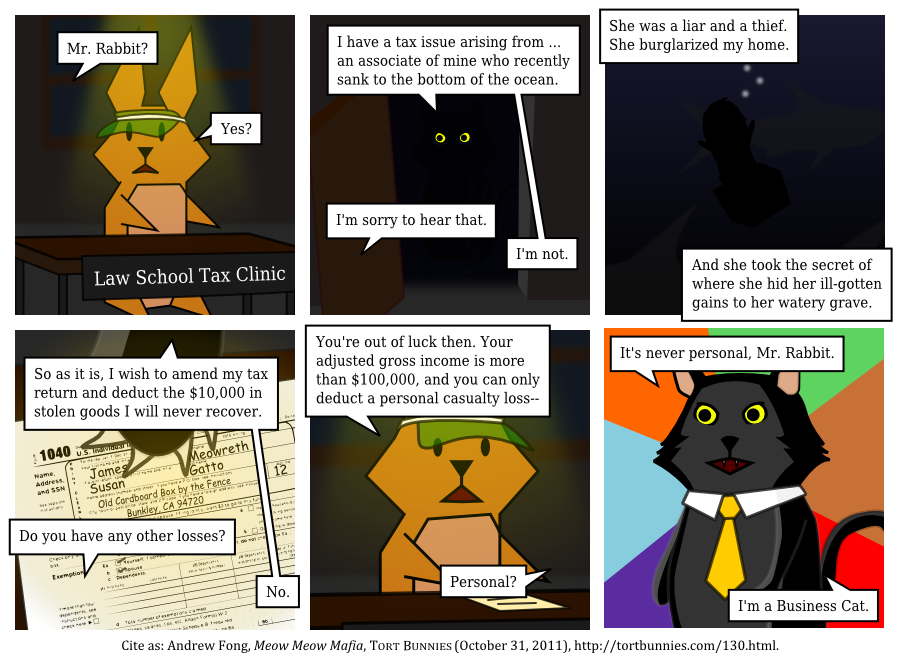

October 31, 2011. Section 165 of the U.S. Internal Revenue Code allows taxpayers to claim a deduction for losses. Taxpayers may claim deductions for personal casualty losses, or "losses of property not connected with a trade or business or a transaction entered into for profit, if such losses arise from fire, storm, shipwreck, or other casualty, or from theft," only to the extent that such losses exceed $100 and 10% of the taxpayer's adjusted gross income.

No such restriction exists for business losses.

A note on cats: A professor I knew had several pet cats. I once asked him why he had so many cats. He responded, "Cats are evil and selfish. And I teach tax law."

Thanks to Ash for pointing me in the direction of the original Business Cat.

Comments